In 2025, generative AI isn’t just a buzzword - it’s redefining financial strategy. From forecasting to fraud detection, AI tools are no longer optional - they’re essential. Institutions are investing heavily in AI to drive productivity and competitive advantage . But small businesses stand to gain the most when AI is applied correctly.

At TRA, we’ve integrated AI-powered bookkeeping and CFO advisory, delivering clarity, control, and confidence - not at a Fortune 500 price tag, but in your neighborhood.

1. Real-Time Bookkeeping = Real-Time Decisions

Manual reconciliation? That’s so 2024. Today, AI autodetects anomalies, categorizes expenses, and flags trends as they happen. No more month‑end surprises - just daily insights that fuel smarter choices.

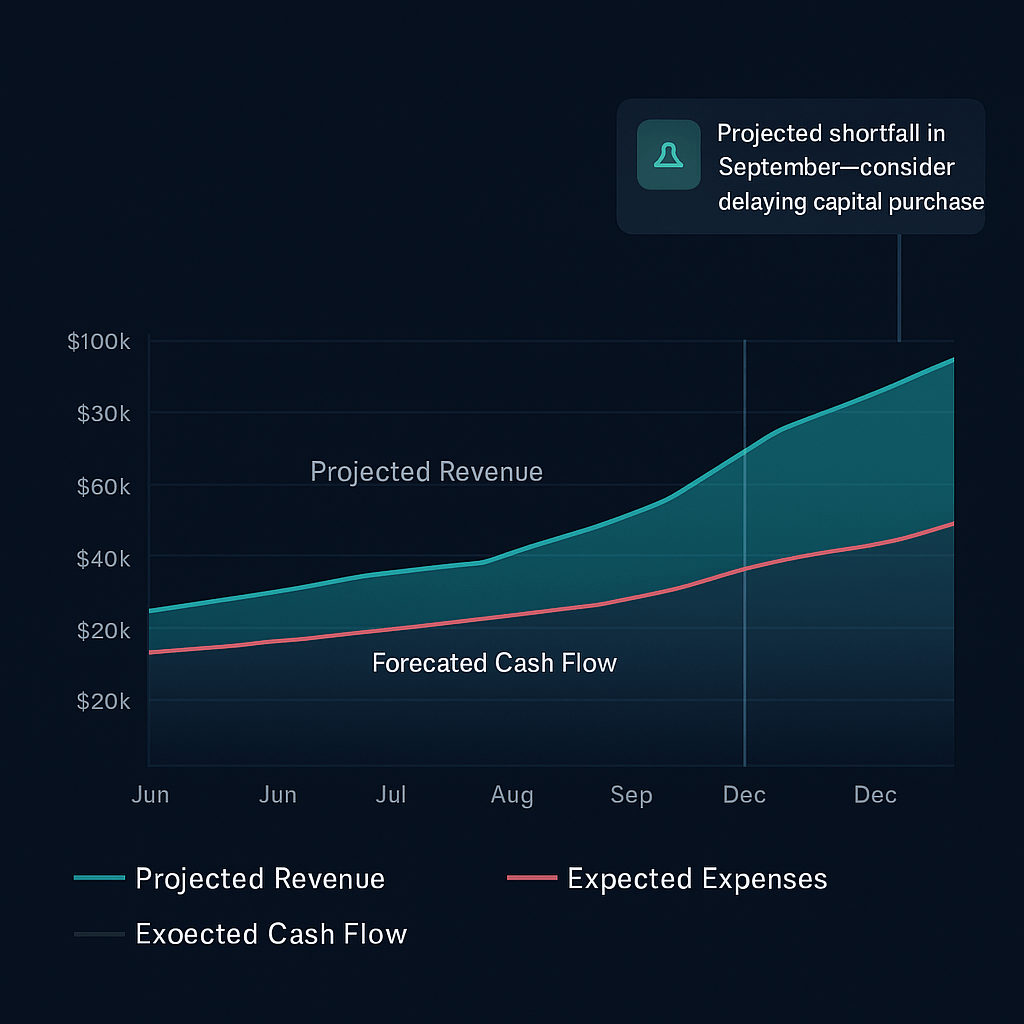

2. AI Forecasting That Finds Opportunity

Forecasts used to be guesswork. Now, AI models trend your revenue and cash flow with precision. Spot seasonal patterns, prepare for slowdowns, optimize payroll, and plan investments well before any crisis hits.

3. CFO Advisory Reinvented with AI

We combined our financial expertise with AI-driven scenarios so you can see “what if?” before decisions are made. Legislation shifts, pricing changes, or investment moves - all can be modeled in a click.

4. Fraud Detection & Compliance You Can Trust

AI watches your books 24/7, flagging discrepancies, outliers, and suspicious activities. With increasing cybersecurity and IRS data-compliance pressure, transparency isn’t just smart - it’s essential.

5. Accessible AI, Always Human-Led

Yes, AI is powerful - but so is human experience. TRA’s team vets AI suggestions, reviews outputs, and makes contextual decisions so you never fly solo.

📈 Why Now?

- AI Integration Is in Overdrive – Financial services are embedding AI in advisory, compliance, and intelligence workflows.

- Small Businesses Need It Most – Inflation, cost pressure, and regulatory changes mean even minor AI gains can have major impact.

- Generative AI’s Leap – Powerful models are now accessible through bookkeeping platforms - not hidden behind enterprise paywalls.

🛠 Real-World Application: Case Study

A Lynchburg boutique reduced month-end close time by 75% using AI‑powered reconciliation, freeing up their bookkeeper to produce weekly cash forecasts that caught a liquidity squeeze before it became a problem.

✅ Your AI Finance Playbook

| Step | What You Do | Why It Matters |

|---|---|---|

| 1 | Book an AI‑bookkeeping demo | See real-time expense tracking in action |

| 2 | Add AI forecasting module | Visualize your cash 12 months ahead |

| 3 | Start CFO + AI scenario planning | Test growth, cost, and tax strategies |

| 4 | Activate AI-driven compliance monitoring | Sleep easy knowing regulatory needs are met |

⚡ Final Takeaway

AI in small business finance is no longer the future - it’s now.

With AI‑backed bookkeeping and advisory from TRA, you gain the insights, agility, and resilience to move ahead confidently - no matter what’s happening in Washington or the marketplace.

👉 Ready to level the playing field? Book your free AI‑powered finance strategy session with TRA today.