2022 Health Savings Account Limits

New contribution limits are on the horizon

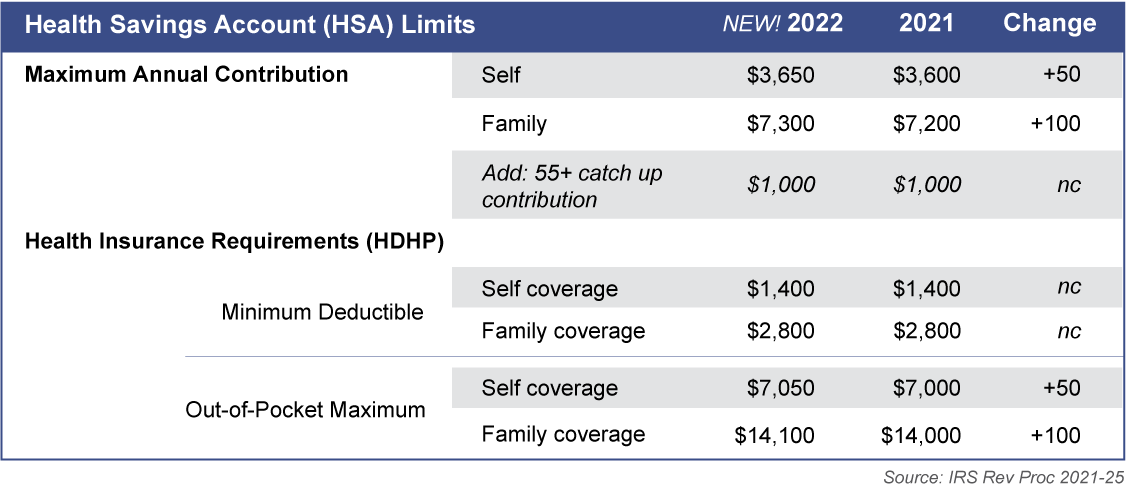

The savings limits for the ever-popular health savings accounts (HSA) are set for 2022. The new limits are outlined here with current year amounts noted for comparison. So plan now for your contributions.

What is an HSA?

An HSA is a tax-advantaged savings account whose funds can be used to pay qualified health care costs for you, your spouse and your dependents. The account is a great way to pay for qualified health care costs with pre-tax dollars. In fact any investment gains on your funds are also tax-free as long as they are used to pay for qualified medical, dental or vision expenses. Unused funds may be carried over from one year to the next. To qualify for this tax-advantaged account you must be enrolled in a high-deductible health plan (HDHP).

The Limits

Note: An HDHP plan has minimum deductible requirements that are typically higher than traditional health insurance plans. To qualify for an HSA, your coverage must have out-of-pocket payment limits in line with the maximums noted above.

The key is to maximize funds to pay for your medical, dental, and vision care expenses with pre-tax money. By building your account now, you could have a next egg for unforeseen future expenses.