2023 Health Savings Account Limits

New contribution limits are on the horizon

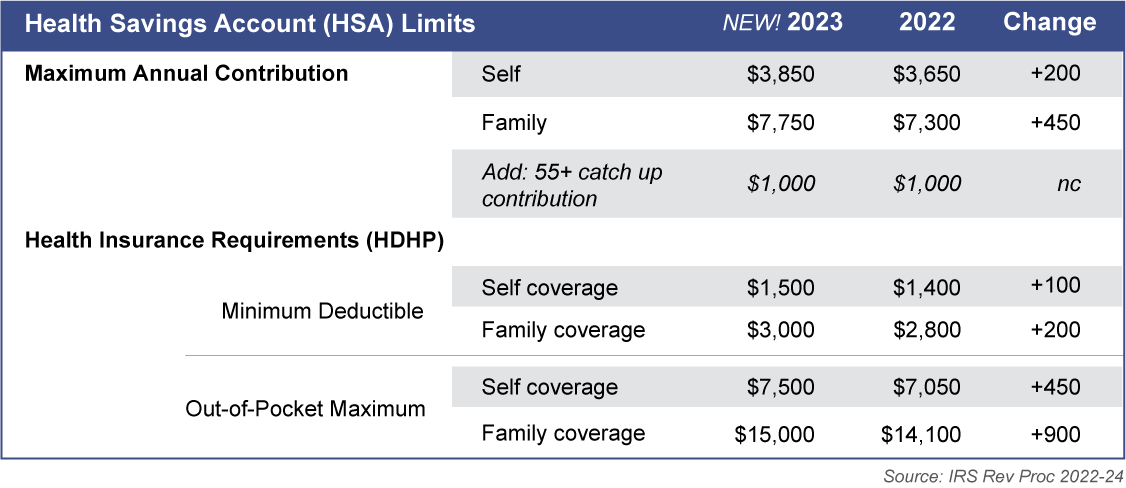

Contribution limits for the ever-popular health savings account (HSA) are set for 2023. The new limits are outlined here with current year amounts noted for comparison. So plan now for your 2023 contributions.

What is an Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account whose funds can be used to pay qualified health care costs for you, your spouse and your dependents. The account is a great way to pay for qualified health care costs with pre-tax dollars. In fact, any investment gains on your funds are also tax-free as long as they are used to pay for qualified medical, dental or vision expenses. Unused funds may be carried over from one year to the next. You must be enrolled in a high-deductible health plan (HDHP) to use an HSA.

The Limits

Note: An HDHP plan has minimum deductible requirements that are typically higher than traditional health insurance plans. To qualify for an HSA, your health coverage must have out-of-pocket payment limits in line with the maximums noted above.

The key is to maximize funds to pay for your medical, dental, and vision care expenses with pre-tax money. By building your account now, you could have a next egg for unforeseen future expenses.

While some of the risk factors are out of your control, many can be minimized. If you are chosen for an audit, don’t deal with the IRS alone – please call for help.

Visit our Tax Planning page for more information.