Why Filing Early Could Save You Money (And Stress)

Tax season is officially here, and while the April 15 tax deadline may seem far away, waiting until the last minute to file could cost you more than you think. Filing taxes early isn’t just about checking a task off your to-do list—it can actually save you money, reduce stress, and even protect you from tax identity theft. Here’s why getting ahead of the game is a smart move:

1. Faster Tax Refunds

The earlier you file, the sooner you get your IRS tax refund. The IRS tax return processing works on a first-come, first-served basis, so if you file early, you’re likely to see your money much faster—especially if you choose direct deposit tax refund.

2. Avoid Last-Minute Tax Mistakes

Rushing to meet the deadline increases the chance of making common tax filing mistakes, like misreporting income, missing tax deductions, or even forgetting to sign your return. Filing early gives you time to review everything carefully and maximize your eligible tax credits.

3. Reduce the Risk of Tax Identity Theft

Tax identity fraud is a real threat. Scammers file fraudulent tax returns using stolen Social Security numbers to claim refunds. If you file before they do, you prevent them from using your information for fraudulent tax refund claims.

4. More Time to Plan If You Owe Taxes

If you end up owing, early tax filing gives you time to budget and explore IRS payment plans instead of scrambling at the last minute to come up with the money.

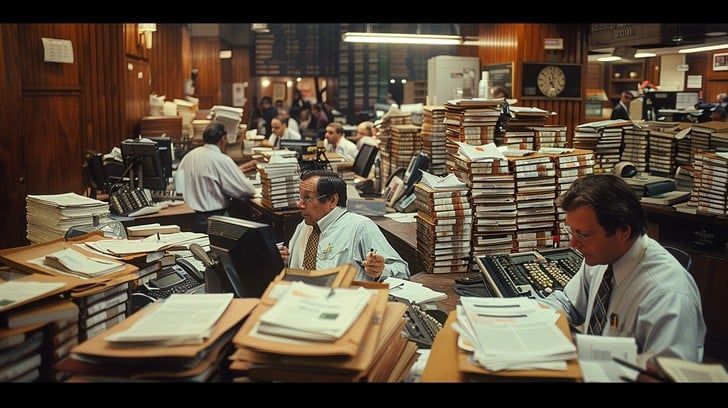

5. Beat the Tax Preparation Rush

Tax professionals get busier as the tax deadline approaches. Filing early ensures you get expert tax advice, accurate filing, and the best guidance for maximizing your tax return refund.

Ready to File? Let’s Make It Easy.

At Tax Resolution Accounting, we make tax preparation services stress-free. Whether you’re expecting a refund or need help minimizing what you owe, we’re here to help.

Get in touch with us today to get started with your tax filing!