IRS Audit Risk 2025: Why Small Business Owners Should Pay Attention

The IRS is now using artificial intelligence (AI) to flag potential tax issues - and small businesses are right in the middle of it.

New technology allows the IRS to scan thousands of tax returns quickly. This helps them spot patterns, red flags, and errors that may lead to an audit. If your books aren’t organized or your deductions aren’t clear, you may be at higher risk - even if you’ve done your best to file correctly.

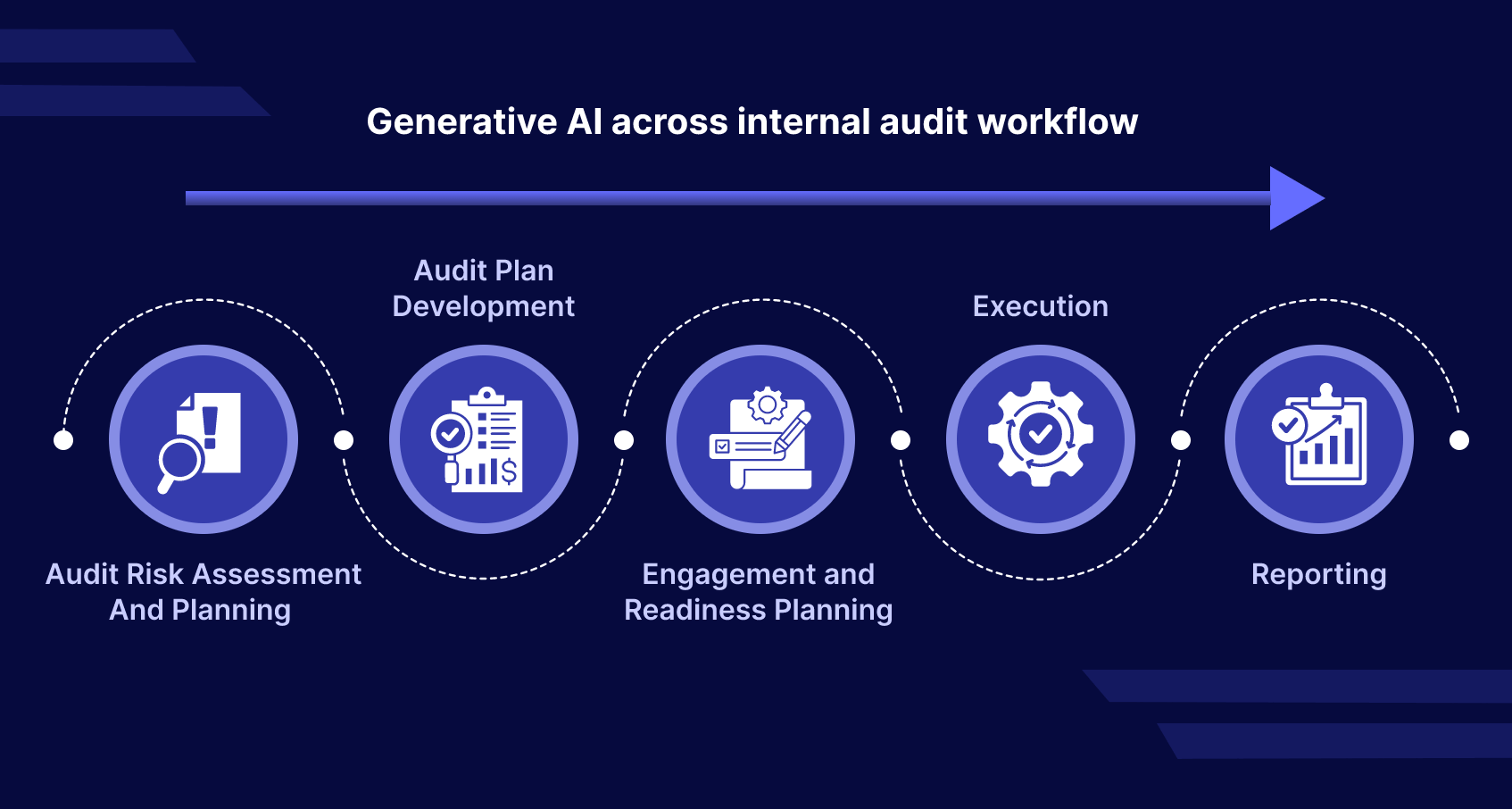

🧠 How the IRS Uses AI in 2025

Here’s what the IRS is doing with AI right now:

- Targeting Audits – AI scans tax returns for signs of mistakes or fraud.

- Reviewing Communication – The IRS is testing tools like ChatGPT to read and respond to taxpayer letters.

- Matching Transactions – AI compares what you reported to what banks, apps like PayPal, or payroll companies say.

🧾 Who’s Most Likely to Be Audited?

You’re at higher risk if:

- You’re self-employed or receive 1099s (freelancers, gig workers, Airbnb hosts, etc.)

- You have cash-heavy transactions

- You’ve mixed business and personal expenses

- You do your own bookkeeping or use outdated systems

AI doesn’t care how big or small your business is. It looks for patterns, and if something seems off - it gets flagged.

🛡️ How to Protect Your Business From an IRS Audit

The good news? You can stay ahead of this. Here's how:

✅ 1. Fix Your Bookkeeping

Sloppy records are one of the biggest red flags. At TRA, we offer bookkeeping clean-up services to make sure everything is accurate and IRS-ready.

✅ 2. Separate Business and Personal Finances

Use different bank accounts and cards. This makes it easier to prove which expenses are business-related.

✅ 3. Work With a Tax Resolution Specialist

If you get a letter from the IRS, don’t panic. We can talk to the IRS for you and help fix the issue fast.

✅ 4. Only Claim Deductions You Can Prove

Don’t guess. We’ll help you take advantage of legal deductions - without raising audit risk.

✅ 5. Book a Mid-Year Financial Check-In

June is the perfect time to pause and look at your finances. A quick review can help you avoid bigger problems later.

🤝 Why TRA Is Different

We’re more than a tax firm. We’re your financial protection partner.

We help:

- Prepare your books for tax season and audits

- Fix past IRS problems and lower what you owe

- Plan ahead so your business can grow with less stress

- Give you real financial insights with our CFO & Advisory Services

📅 Let’s Talk Before the IRS Does

The IRS is using smarter tools. That means you need a smarter strategy.

Let’s take a look at your books, fix any risks, and make sure you’re protected - all before problems start.