Warning! IRS Announces NEW 2022 Mileage Rates.

Tax Resolution Accounting • July 5, 2022

IRS Announces NEW 2022 Mileage Rates

New rates begin in July

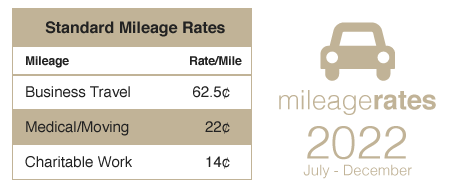

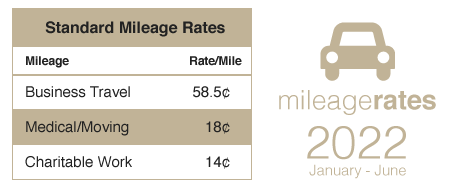

In a recent announcement, the IRS raised the standard mileage rates for travel beginning in July, 2022. Use the previously announced mileage rates for qualified travel in the first half of the year. Use the revised rates for travel in the second half of 2022.

NEW Mileage rates for JULY through DECEMBER 2022

2022 Mileage Rates JANUARY through JUNE

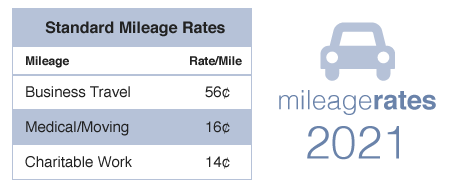

Here are the 2021 mileage rates for your reference.

2021 Mileage Rates

Remember to properly document your mileage to receive full credit for your miles driven.

Visit our Tax Planning page for more information.