Bookkeeping isn’t sexy. It’s not glamorous. It doesn’t trend on TikTok. But you know what is hot? Not getting audited, overpaying taxes, or accidentally bankrupting your business because your receipts are stuffed in a shoebox next to your 2019 New Year’s resolutions.

Welcome to the dark side of bad bookkeeping - and how it slowly, silently drains your money like a financial vampire.

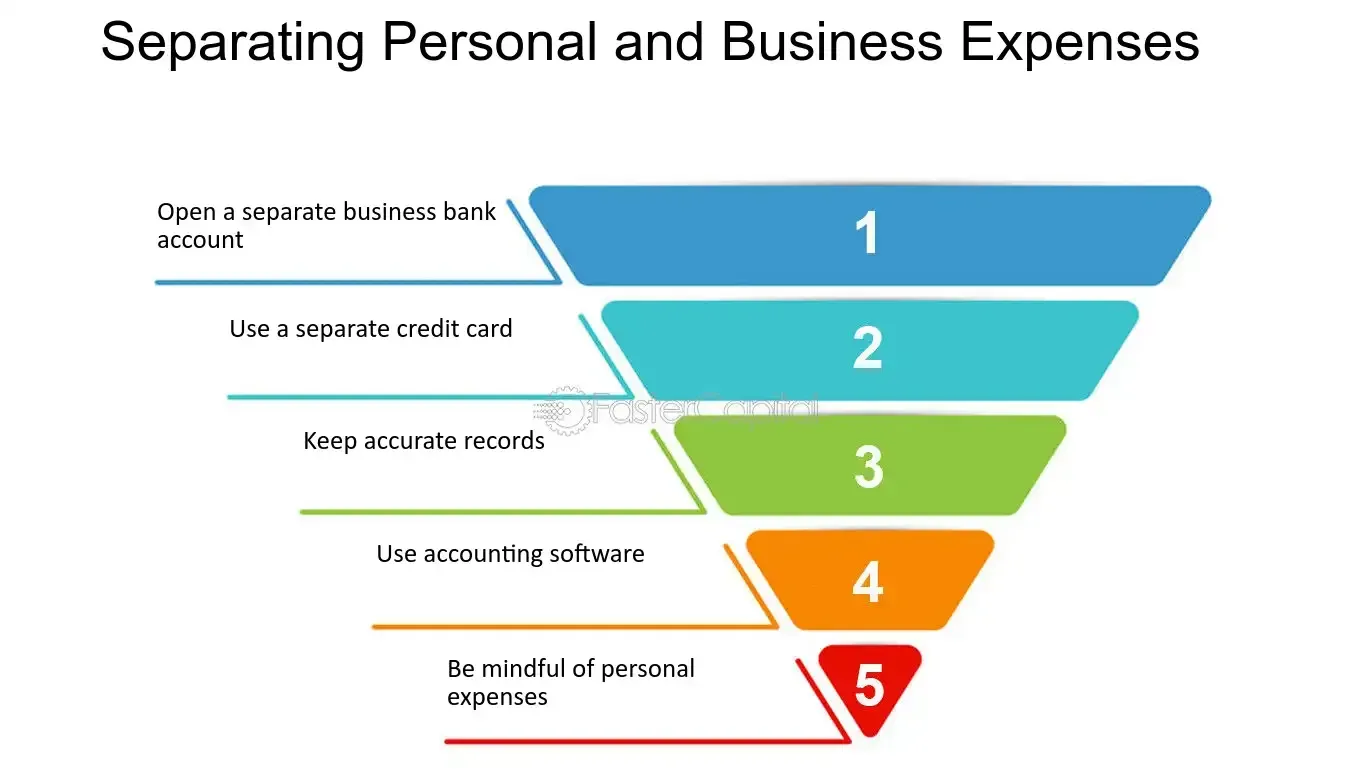

Mistake #1: Mixing Business and Personal Finances

If your business credit card and your DoorDash habit share a wallet, you’re asking for trouble. It’s not just messy. It’s a tax-time nightmare - and it screams amateur to anyone trying to invest in or buy from you.

Mistake #2: DIY Gone Wrong

Spreadsheets are cute until you miss a decimal and your quarterly report turns into a horror story. Just because Excel is free doesn’t mean your time, sanity, or audit defense should be.

Mistake #3: No Monthly Reconciliation

If you’re not checking your books monthly, you’re not managing your business - you’re just hoping. Hope is not a strategy. TRA is.

Mistake #4: Ignoring Professional Help

You wouldn’t pull your own teeth. Why pull your own books? (Especially when the pain is just as intense.)

What to Do Instead:

- Let TRA assess your books for red flags, landmines, and lost dollars.

- Get monthly check-ins so you actually know what’s going on.

- Sleep better knowing your finances aren’t a ticking time bomb.

Bottom Line: Bad bookkeeping doesn’t make headlines - it just quietly ruins your profits, wrecks your taxes, and makes your life way harder than it needs to be. But the fix is simple: call us. We’ve got the tools, the team, and the trauma training to turn your books from horror show to hero story.

Let’s stop the financial bleeding. Or at least put down the duct tape and do it right.