The Corporate Transparency Act: An Unexpected Turn

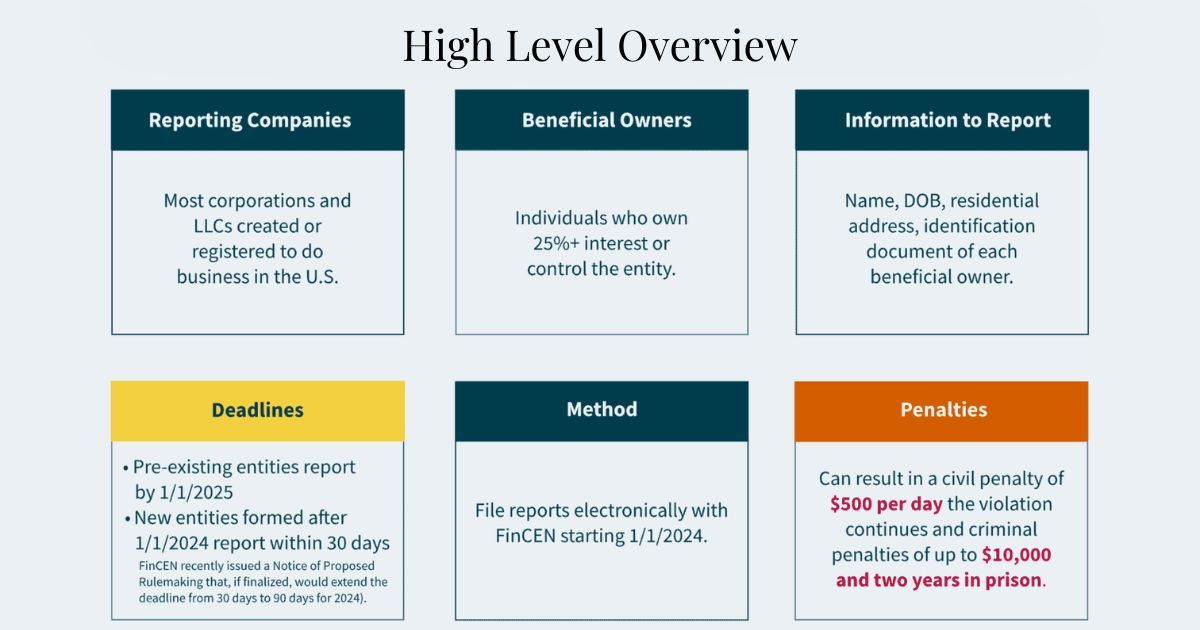

In a surprising turn of events, businesses now have more time to prepare for Beneficial Ownership Information (BOI) reporting under the Corporate Transparency Act (CTA), which we emailed our clients about in recent weeks.

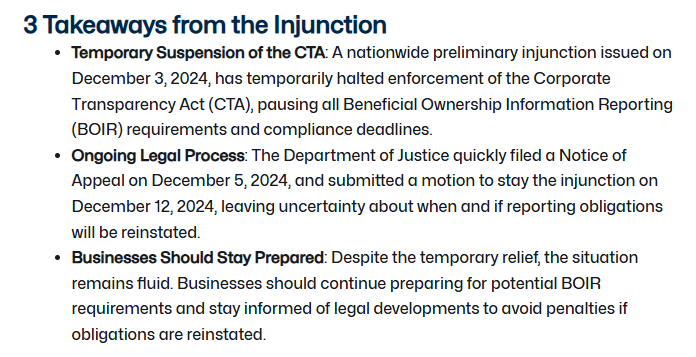

On December 10, 2024, FinCEN announced a nationwide pause on enforcing the Corporate Transparency Act (CTA) following a court injunction.

While FinCEN maintains the CTA is constitutional, businesses are not currently required to file their BOI reports, and no penalties will apply while this injunction stands.

This pause comes just weeks before the original January 1, 2025, deadline, offering businesses a chance to refocus and prepare.

While the legal landscape remains uncertain—with other cases challenging the CTA still progressing—it’s clear that staying informed and ready is critical.

Why You Shouldn’t Wait

The pause doesn’t mean BOI reporting is gone forever. When the injunction is lifted, the reporting requirements may return quickly.

Proactively organizing your BOI information now will position your business for success, avoiding last-minute stress or penalties if enforcement resumes.

We’re Here to Help

At Tax Resolution Accounting, we’re committed to guiding you through this complex time. Whether you need clarity on your obligations or help with preparation, our team is ready to assist.

Stay ahead by scheduling a consultation today. Together, we’ll ensure your business is positioned to thrive no matter what changes come.